GameStop stock hits record high (again!) as Reddit group causes mayhem

A hot potato: GameStop's stock spiked on Friday when hedge funds sensed a drop in stock price and attempted to "brusque" the marketplace. A grouping of redditors bolstered enthusiasm for the stock however and forced traders to quickly buy back the stock for fearfulness of losses, leading to a massive 69 percent rise in stock cost in just one day.

Video game retailer GameStop's stock rose past nearly 70 percentage on Friday causing a halt in trading. The price spike in the visitor'southward market place value was attributed in part to a grouping of day traders on the subreddit r/wallstreetbets, which led to a scramble by investment firms to capitalize on the pricey stocks.

Update (ane/27): Craze is far from over. The virtual aggrandizement of GameStop's stock has the company now valued at $22 billion as the share toll escalated to over $320 on Wednesday. Meanwhile, the same r/wallstreetbets reddit group is now targeting other stocks like AMC Theatres and Blackberry.

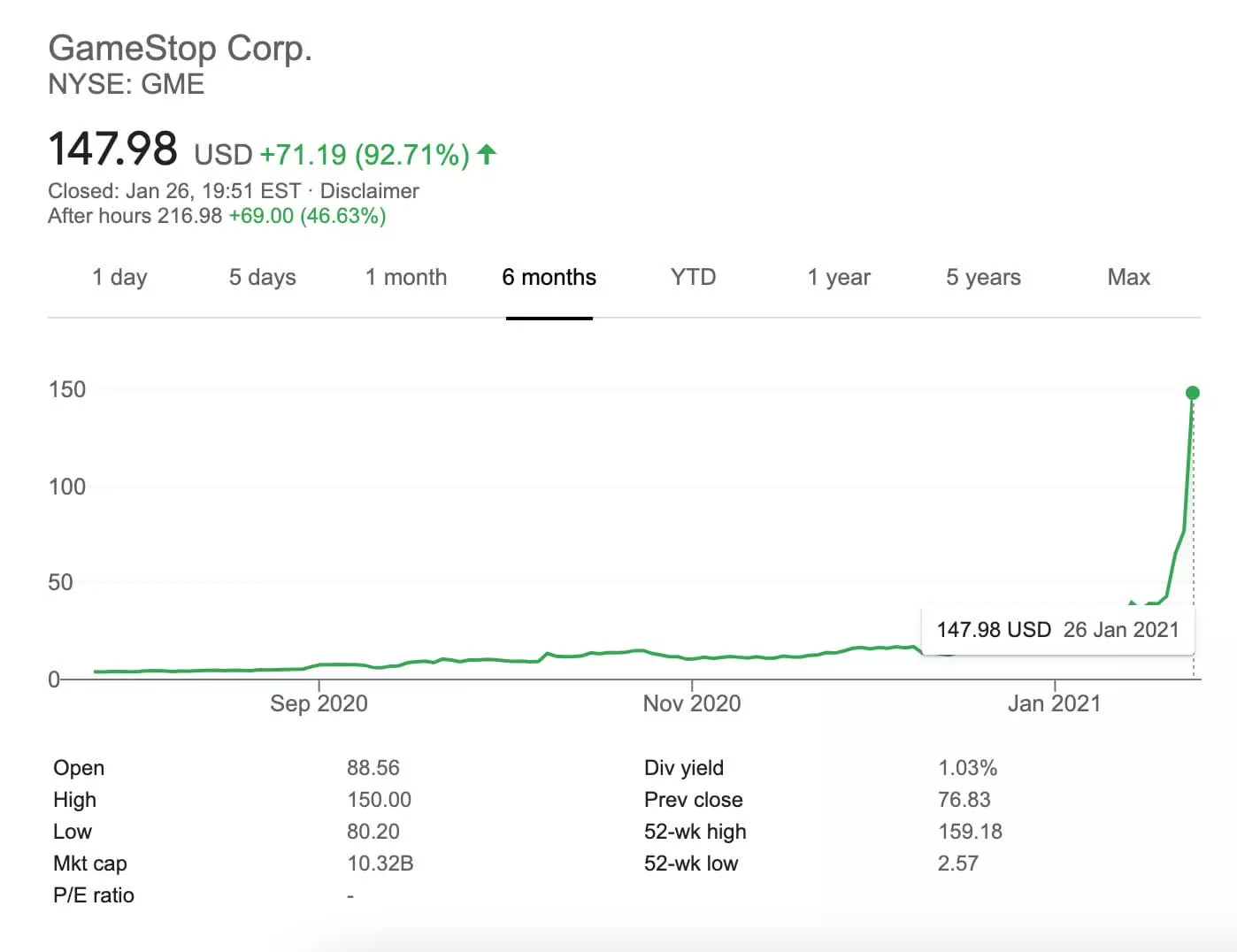

Update (ane/26): At the marketplace closing Tuesday, GameStop's stock was valued at $147.98 per share, climbing 92% in a single mean solar day's trading. By most metrics, it'southward unsustainable and not reflecting reality, all the same if for whatsoever reason you owned some GameStop stock, congratulations. Time to sell.

Update (1/25): Every bit of market opening on Monday, GameStop'southward stock soared again to over $115, not ceasing to amaze, fifty-fifty though it'south clear this is the result of toll manipulation.

The video game retailer'southward stock cost is upwards more than 250 percent compared with this time last year following to appointment of GameStop's newest board member, Chewy co-founder Ryan Cohen.

Hedge fund Citron Research aimed to short GameStop's stock post-obit Cohen's appointment, expecting stock prices to autumn, however the Reddit's traders apace led to what is chosen a "short squeeze."

For fans of the film The Large Short, it is difficult to compete with Margot Robbie marketplace-splaining investment strategies from a bubble bath with a glass of champagne, but here is a valiant effort.

When traders sense that a company's stock volition fall, they can "brusque" the market place by borrowing stocks from other investors and sell it at a high price. When the stock falls, they buy it back for profit. Other firms volition typically encounter this tendency and follow suit. The activity of this avid Reddit group yet led to an upward trend in the stock that caused the shorts to apace buy dorsum their stock to brand up for their losses, often to the detriment of their competitors.

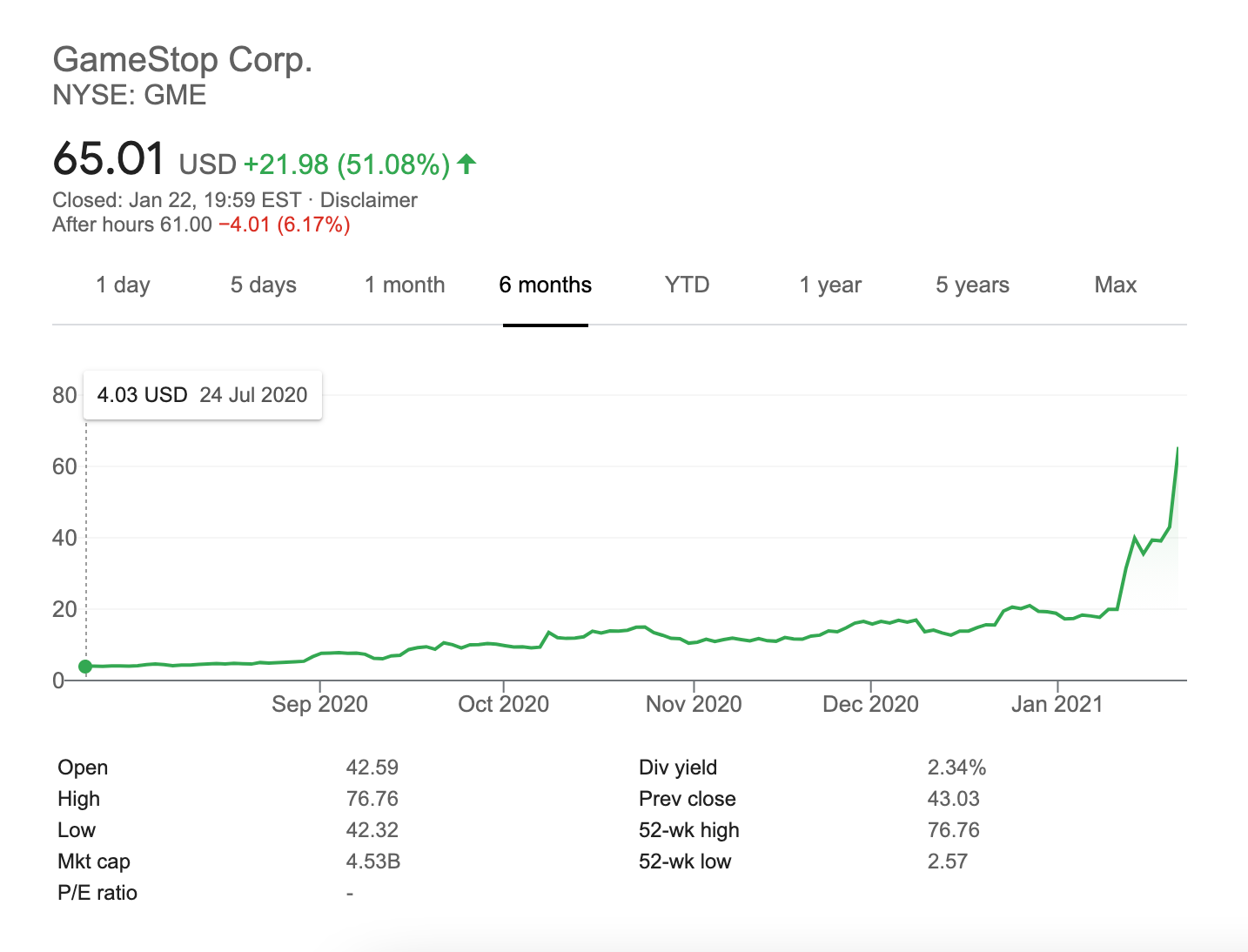

Before long, GameStop's stocks were priced at $76.76, a massive climb from the $twenty price tag on January 12.

A Bloomberg article deemed GameStop the most actively-traded and nearly-shorted stock on the market. The stock marketplace froze trading in GameStop multiple times due to high instability on Friday when it rose 69 percent, though it has since resumed.

When trading ceased on Friday, GameStop's stock was upward more than than 50 percent within 24 hours, with a market value at $four.five billion.

Tomorrow am at 11:30 EST Citron will livestream the 5 reasons GameStop $GME buyers at these levels are the suckers at this poker game. Stock back to $xx fast. We sympathize short interest meliorate than you lot and volition explain. Thank you to viewers for pos feedback on terminal live tweet

— Citron Enquiry (@CitronResearch) January xix, 2022

Citron responded to the contempo activity past warning those investing in the stock that information technology would soon fall back to $20, tweeting that "buyers at these levels are the suckers at this poker game."

Source: https://www.techspot.com/news/88390-gamestop-stock-hits-record-high-reddit-group-causes.html

Posted by: carterancralows1973.blogspot.com

0 Response to "GameStop stock hits record high (again!) as Reddit group causes mayhem"

Post a Comment